How Banks Could Have Preempted De-Banking Christians & Conservatives Allegations

News coverage of the narrative that banks are de-banking Christians and conservatives exploded in mid-April 2024 — as a number of Republican state officials issued a warning to Bank of America over its alleged practices of politicized de-banking targeting conservatives.

Our “Detect. Decipher. Defend.” Framework

Detect:

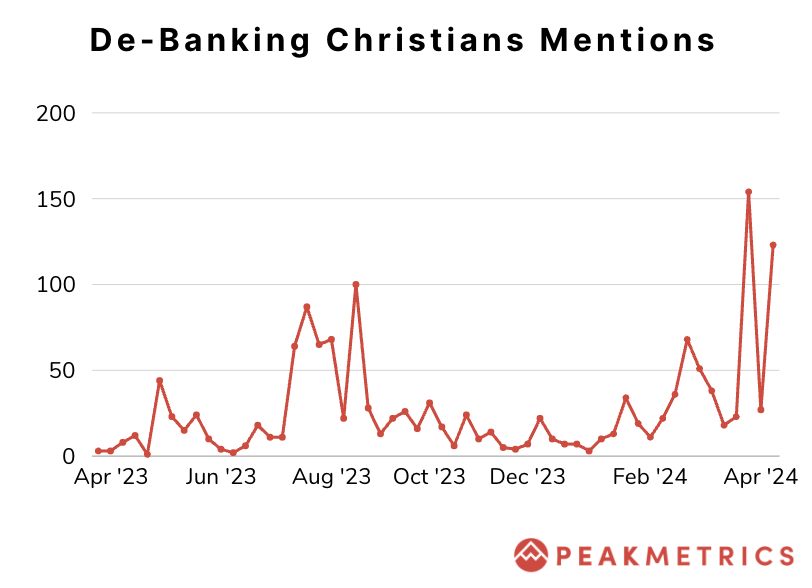

PeakMetrics detected that mentions of banks ‘de-banking’ Christians and conservatives had several acceleration points over the past year, including July 2023 and March 2024.

The narrative began to accelerate online several weeks before reaching a peak in August 2023 and April 2024. These early indicators offer an opportunity to get ahead of major inflection points in the spread of this damaging narrative for U.S. financial institutions.

Decipher:

American conservatives appear to have picked up the issue from over the pond. The mentions from July-August 2023 generally relate to the UK government beginning to look into concerns over banks allegedly blacklisting certain customers over their politics — namely former Brexit Party leader Nigel Farage. The narrative began to cross over to American conservatives in Fall 2023 — including a CBN News report on September 18th and an October 16th article from the Christian Post. The issue began to pick up real political steam in late February 2024, when Tennessee and Arizona legislatures introduced bills that would prohibit financial de-banking for political or religious beliefs.

Defend:

In March 2024, banks needed to begin preparing to deal with this reputational threat going viral based on the bills introduced in February. The Alliance Defending Freedom took up the issue publicly in March, testifying before Congress and petitioning the SEC. By mid-March, major conservative publications were really picking up coverage of this narrative. A month later, the narrative exploded with the state lawsuits against Bank of America. Other banks mentioned in relation to this narrative, other than BoA, include USAA, Chase, Charles Schwaab, and Wells Fargo.

PeakMetrics: Your partner in proactive reputation management

In today's fast-paced digital world, speed is everything. Narrative intelligence equips you with the tools and insights you need to act swiftly and effectively.

Request a demo to learn more about how PeakMetrics can help you leverage narrative intelligence and proactively guard your brand reputation.

Request a free report

Uncover emerging narratives around your brand, industry, and competition.

Sign up for our newsletter

Get the latest updates and publishings from the PeakMetrics investigations team.